Disclaimer: I am not a financial advisor. I’m a blueberry. I possess no formal financial education, no advanced degrees, and possibly no brain cells. I am merely a moron with a Substack. Absolutely nothing in this article is truthful, factual, or even remotely accurate—it is pure, unfiltered parody. While I will reference various complex concepts, I will simplify them to a level that makes sense to me, which means they will become entirely nonsensical and wrong. Please do not take anything in this article seriously or as advice. I am making all of this up. None of it is true. Not a single word.

I read a post recently about “Alpha in reading the contract specs”1 where the author reaches the conclusion that Deribit options right before expiration are routinely overpriced due to the final settlement 30 minute TWAP component. I think in reality, it’s probably a coin toss as to whether this is from the MMs not knowing about the TWAP versus just not understanding how that changes the way these contracts need to be priced. (If you don’t know why exchanges have to have some weighted average settlement price then look up what ‘banging the close’2 is.)

Regardless of the reason for the mispricing, I (respectfully) think that the author missed the bigger point about pricing options— TTE (time to expiration) input should not be linear w.r.t. time passing. When you have a period when the underlying is averaged, you effectively have less time for random motion as part of the settlement is already determined, plus the fact that the future random walk will be averaged in as well.

Let’s start by calculating the equivalent time to expiry, T, of the option at the start of the 30 minute TWAP period. Assume the futures price follows a Brownian motion driver with volatility, σ.

Define the TWAP

Write the stochastic part as

Hence

Equivalently, a standard Black–76 option with time to maturity T/3 has the same variance as the TWAP option with time to maturity T.

The original author thought about this problem as a change in input variance to price the options however, and came to the conclusion that roughly halving the variance priced them correctly. If we think about this from a change in input variance (as stated before I think the more natural way to approach this is from changing input T), then we can actually get the exact change of variance to be:

so the author’s rough half approximation isn’t too far off from reality.

Now, these calculations were of course assuming that we are at the full start of the 30 minute TWAP period, so let’s run through the calculations once we are are already into the TWAP period.

At time t (0 <= t <= T), the portion

is already fixed. Let g = T-t. The still-random portion of the integral is

Using a fresh Brownian motion

Define the effective residual maturity

so that the yet-to-be-determined part of the TWAP has the same variance as a standard option with time-to-expiry τ_eff. Notice τ_eff decays quadratically faster than the linear T−t of a plain option, reflecting that more of the settlement price is locked in as time passes.

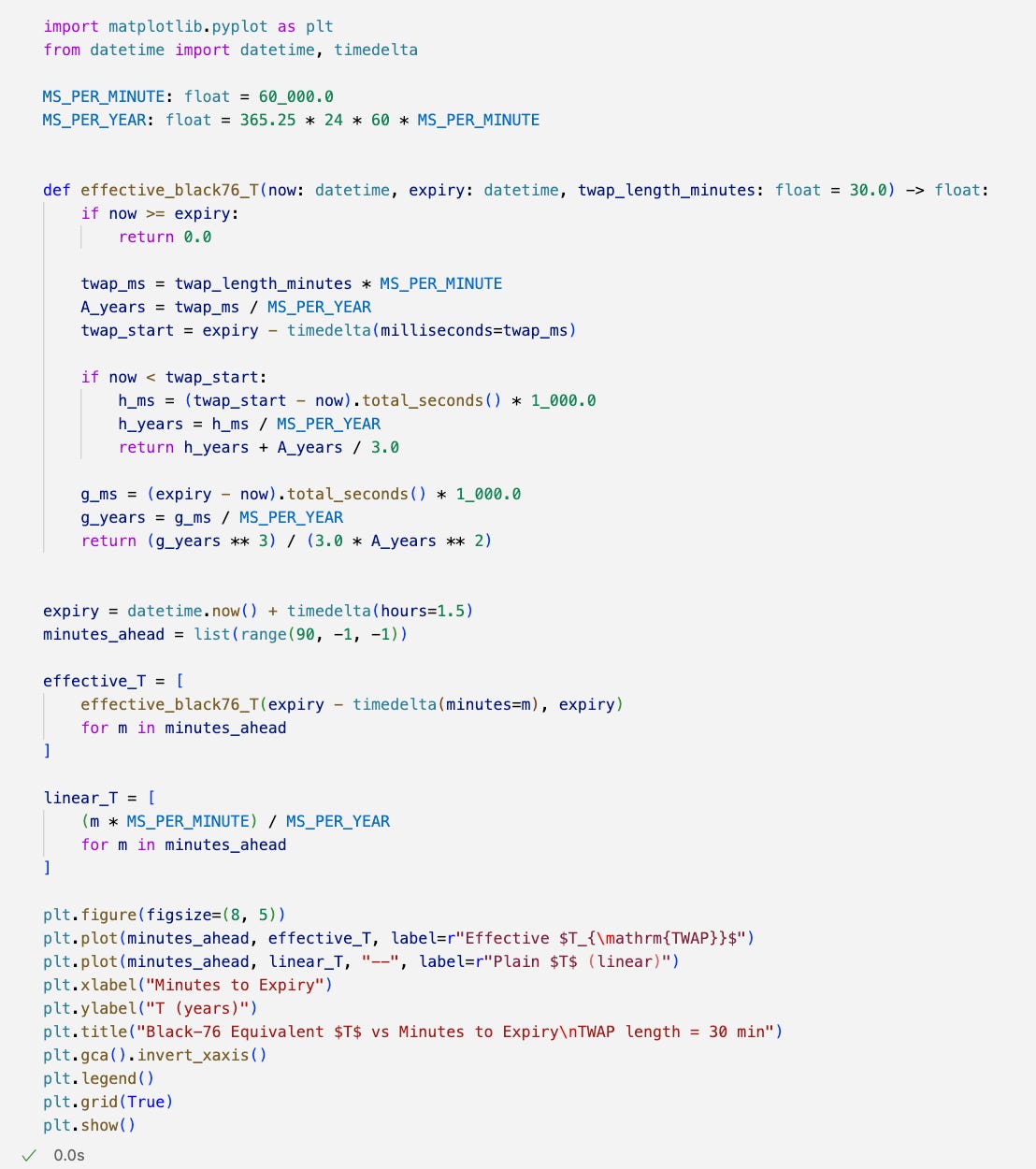

As with most things, I think a visualization of the difference in input for T is helpful.

The concept of non linear time to expiration inputs should not be foreign to anyone sitting on a real options desk. Equity option traders should all understand that their theta decay curves reflect the fact that there is much more action in the first five minutes of the trading day than some other random five minute period during the day, or the fact that weekends don’t have the same weight as regular trading days. Crypto options desks need to factor in the difference between APAC and US trading hours, etcetera. Sharing the exact weights used for different time periods is something that I will not share because 1) that’s actually proprietary and 2) it is something that requires constant tweaking so even if I gave the values used today, those would (likely) be suboptimal later down the line anyway.

Alpha in Reading the Contract Specs. https://www.algos.org/p/alpha-in-reading-the-contract-specs

MarketsWiki. (n.d.). Banging the Close. https://www.marketswiki.com/wiki/Banging_the_Close