Prediction (Gambling) Market Correlations

leveling up Avellaneda-Stoikov

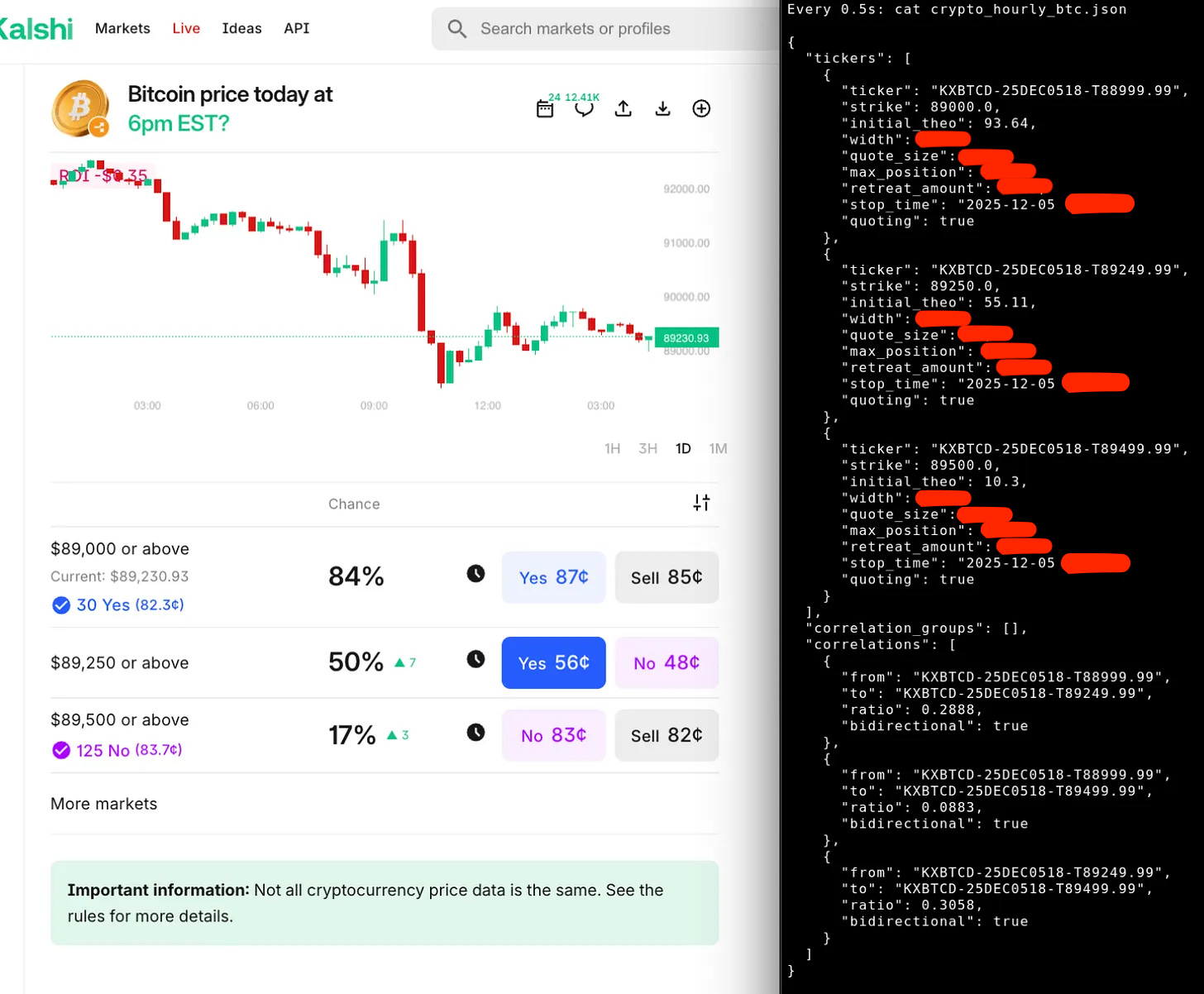

Taking into account one’s portfolio as a whole, rather than each individual ticker/component individually is important…like really important. Anyway, let’s take a really simple example using some personal projects that I’ve been working on recently: crypto binary options!

Note: No crying in the casino. I am a toxic counterparty. If you think about just pulling vols from Deribit, then I would like to thank you for your flow in advance!

Anyway, if BTC expires above 89,250 then it had to have expired above 89,000 as well right? And this is true for it expiring above any strike then clearly it had to have expired above all strikes below it. I feel like this is something that I shouldn’t even have to really state??

Suppose that we have a series of probabilities for our strikes (strike in increasing order) and we have probabilities (theos) s_i and s_j such that s_j is for a strike strictly higher than s_i. It follows that s_i > s_j and that the j-th strike can only expire in the money if the i-th strike also does. We can get the closed from correlation of this.

Anyway, recall that the optimal position adjusted reserve price for HFT market making from Avellaneda-Stoikov is:

where q_t is the current inventory. We can apply our knowledge of correlations to get our effective current inventory as follows:

and now we’ve got a reserve price that takes into consideration our portfolio as a whole.

Deribit vols are still garbage? No surprise ;)